By SRSrocco:

By SRSrocco:

I have been spending a great deal of time going over the balance sheets of mining companies to get a better TRUE COST of SILVER PRODUCTION.?? I have put out a request for anyone in the accounting profession to assist me in this matter.? After the initial interest, it seems as if these folks have backed off? for whatever reason.? I don?t plan on stopping before I can figure out a BETTER WAY to cost out gold and silver and not the pathetic industry standard of ?CASH COSTS?.

Cash costs exclude depreciation, depletion and amortization, accretion, corporate general and administrative expenses, exploration, interest, and pre-feasibility costs.? How can a mining company or the industry as a whole use?CASH COST figures to show the investing public true costs of mining silver?? They do it to MISLEAD the public.

?I have had some SilverDoctors members reply to my previous post on Alexco Resources.? One member told me about another so-called extremely LOW COST SILVER PRODUCER named Dia Bras Exploration.

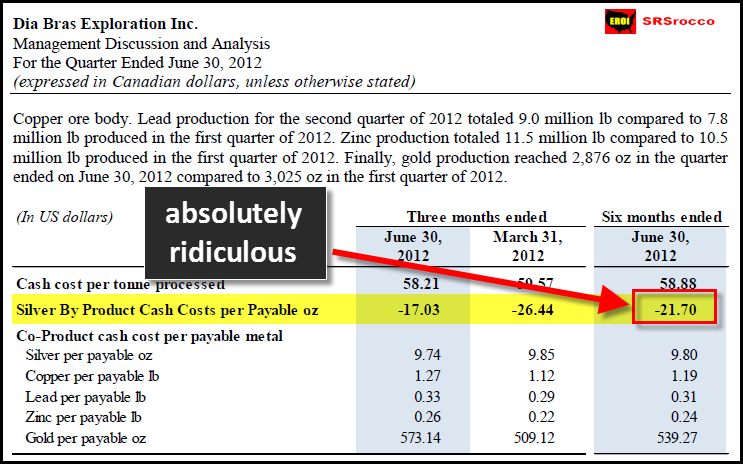

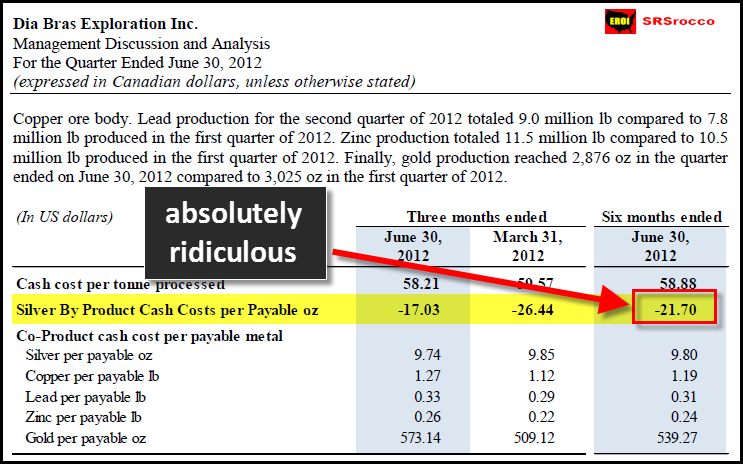

So, I took on the challenge and researched Dia Bras.? According to their Q2 2012 report, this is what they stated for their 1H 2012 SILVER CASH COST:

Isn?t that amazing? a NEGATIVE $21.70 per ounce silver cash cost.? For Pete sakes, Dia Bras should be rolling in the DOUGH? correct?? I mean, they aren?t mining silver at a ZERO CASH COST? they are mining it for $21 less than FREE?LOL.

If we look at their Consolidated Balance Sheet Q2 2012, we can see that on the bottom row, they had a NEGATIVE $6.7 million net income loss for the first half of 2012.? How in the living blazes can a company state a negative $21 cash cost and lose money?

It?s simple?. ACCOUNTING 101.

The member on SilverDoctors website thought that Dia Bras was an extremely low cost silver producer?. they are not.? They are still showing a negative net income.

Furthermore, you can see that Dia Bras has acquired $9.137 million in deferred taxes in just the first 6 months alone.? At some point in time they will have to pay these taxes won?t they?? Hell, I stated in yesterday?s post on Barrick that it had something like $4.3 billion in deferred taxes.

CASH COSTS ARE BOGUS

I have also posted this from Coeur de? Alene?s Q2?2012 report on cash costs:

Cash costs exclude depreciation, depletion and amortization, accretion, corporate general and administrative expenses, exploration, interest, and pre-feasibility costs.

I am repeating myself to make an important point.? How can a mining company or the industry as a whole use?CASH COST figures to show the investing public true costs of mining silver?? They do it to MISLEAD the public.

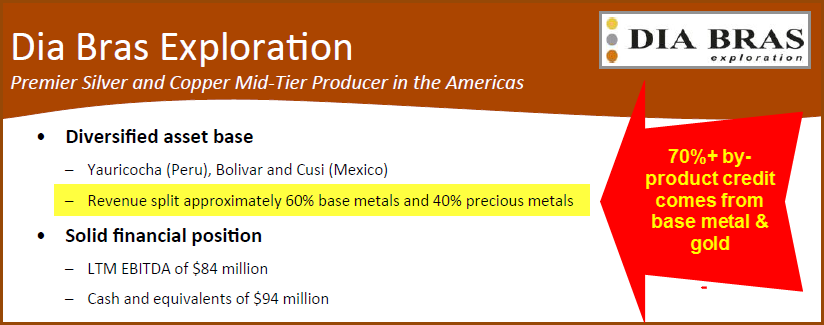

I would imagine there are a great deal of investors who really think Dia Bras Exploration is a VERY LOW COST SILVER PRODUCER.? However, I will show you from Dia Bras recent presentation their breakdown in metal revenue:

If they are getting 40% from their gold and silver revenue, I would imagine that we can safely state that they receive 10% of that 40% from gold.? That means they are taking 70% of their revenues and throwing it against their silver.? This is totally ridiculous.? I am surprised this is allowed in the industry.

Check out these similar articles:

- NUMBERS DON?T LIE? ONLY HUMANS DO- Gold Mine Costs Jumped 19% in H1 2012

- ETF ?Costs and Liabilities? Sees Investors Migrating to Physical Gold

- BARRICK?S Q3 EARNINGS GET SLAUGHTERED 55%, NEWMONT?S DECLINE NEARLY 20%

- Silver Miners HECLA & COEUR D? ALENE LOSSES & COSTS GO VIRAL

- Manipulating LIBOR Allows Banks to Lease & Dump Gold at Artificially Low Costs

Source: http://www.silverdoctors.com/cash-costs-are-completely-bogus-are-misleading-pm-investors/

mississippi state chris carpenter chris carpenter dick cheney hcg drops reason rally mad hatter

No comments:

Post a Comment